deferred sales trust pros and cons

Are you interested in becoming a deferred sales trust expert. The Deferred Sales Trust is a unique strategy for entrepreneurs and investors looking to maximize the sale value of their business assets and real estate.

What Are The Pros And Cons Of Delaware Statutory Trusts

In this video were going to take a look at the pros and cons of deferral sales trust.

. The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. Let us conclude by discussing some of the pros and cons of deferred sales trusts.

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. The primary benefit of deferred sales trusts is the. Deferred Sales Trust Pros and Cons.

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. As stated the DST is not for everyone. It is a common.

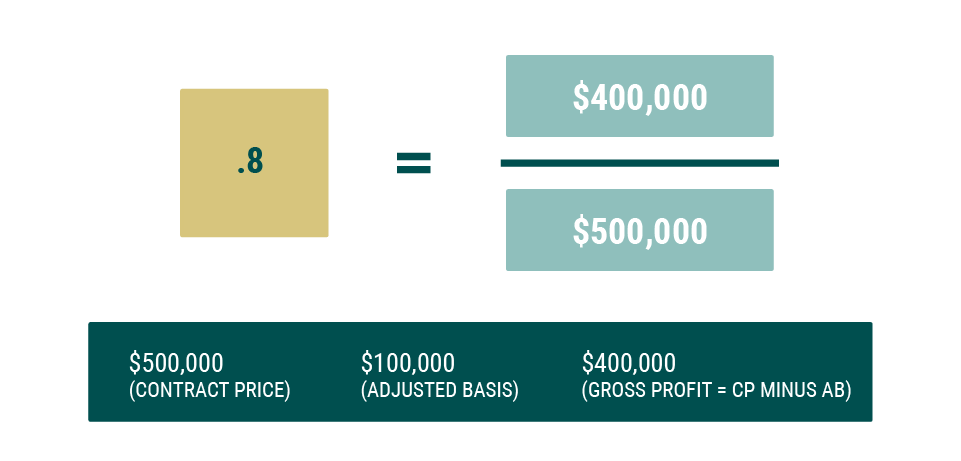

You need to face a 250000 or greater gain on your sale with a resulting tax payment of at least 80000 for the DST to be. A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed. Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated.

Most of the clients also choose a lower. In fact a 2018 study found that more than one in five NQDC participants expect their deferred compensation plan savings to provide more than 25 of their income throughout retirement. We will explore why so many high net worth individuals are leveraging.

Deferred Sales Trust Pros And Cons Dave Saves His 1031 When He Sells 128 Units And Uses Dst Youtube

Delaware Statutory Trust 1031 Exchange Pros And Cons

Delaware Statutory Trusts A Comprehensive Guide With Pros And Cons

Delaware Statutory Trust Dst 1031 Investment Pros Cons

Capital Gains Tax Surgery Cayman Capital

1031 Exchange Alternative Capital Gains Tax On Real Estate

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Tax Considerations When Selling Your Business Bessemer Trust

Deferred Sales Trust Oklahoma Bar Association

The Pros And Cons Of Deferred Revenue Saas Metrics

Deferred Sales Trust Pros And Cons Dave Saves His 1031 When He Sells 128 Units And Uses Dst Youtube

Pros And Cons Of A 1031 Exchange

Pros And Cons Of Investing In A Delaware Statutory Trust

When Does It Make Sense To Elect Out Of The Installment Method

Deferred Sales Trust 101 A Complete Guide 1031gateway

Advanced Planning Deferred Sales Trusts The Quantum Group

What Is A Deferred Sales Trust